In today's digital age, customized personal checks remain a timeless and practical choice for managing finances. Whether you're looking to add a personal touch or simply prefer the convenience of check writing, customizing your checks can be both functional and stylish. In this comprehensive guide, we'll explore everything you need to know about personalized checks, from design options to security features.

With the rise of digital payment methods, many people still rely on checks for specific transactions. Personalized checks offer a level of security and personalization that digital alternatives often lack. This guide aims to provide you with valuable insights into the world of customized personal checks, ensuring you make informed decisions when choosing or designing your checks.

By the end of this article, you'll understand the benefits of personalized checks, how to select the right design, and the security features to consider. Let's dive into the details of why customized personal checks are still relevant in today's financial landscape.

Read also:Anjali Arora Mms Videos Unveiling The Truth Behind The Controversy

Table of Contents

- What Are Customized Personal Checks?

- Benefits of Personalized Checks

- Design Options for Customized Checks

- Security Features in Personal Checks

- Costs and Pricing for Customized Checks

- How to Order Customized Personal Checks

- Popular Providers of Customized Checks

- Tips for Choosing the Right Design

- Legal and Security Considerations

- The Future of Personal Checks

What Are Customized Personal Checks?

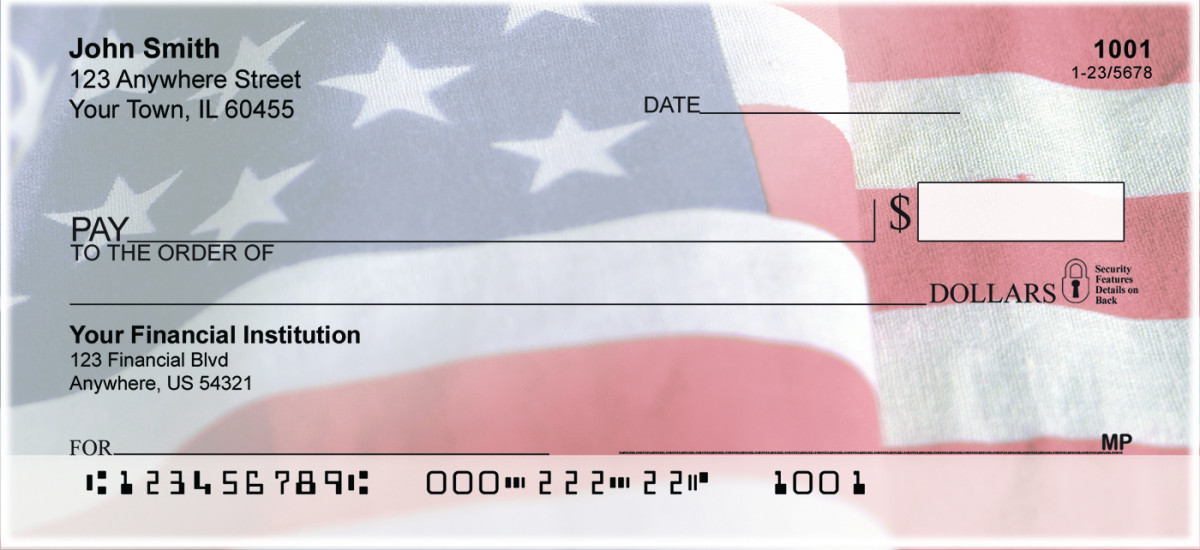

Customized personal checks are financial instruments that allow you to personalize your checks with unique designs, images, or text. Unlike standard checks, personalized checks can include your name, address, and even custom graphics or logos. These checks are ideal for individuals who want to add a personal touch to their financial transactions while maintaining professionalism.

According to a study by the Federal Reserve, although the use of checks has declined, they remain an essential payment method for specific transactions, such as rent payments or large purchases. Customized checks not only enhance security but also make your financial documents stand out.

Why Choose Customized Checks Over Standard Checks?

When choosing between customized and standard checks, consider the following:

- Customized checks offer a unique design that reflects your personal style.

- They include security features that make them harder to counterfeit.

- Personalized checks are easier to identify, reducing the risk of fraud.

Benefits of Personalized Checks

There are numerous advantages to using customized personal checks. Below, we outline the key benefits:

1. Enhanced Security

Customized checks often come with advanced security features, such as watermarks, color-shifting inks, and microprinting. These features make it more challenging for counterfeiters to replicate your checks, ensuring your financial transactions remain secure.

2. Personalization

With personalized checks, you can add your name, address, and even custom images or logos. This level of personalization makes your checks unique and reflects your individuality.

Read also:Exploring The Enchanting Beauty Of Salice Rose

3. Professionalism

Whether you're writing a check for business or personal purposes, customized checks convey a sense of professionalism. They make a positive impression on recipients and reflect your attention to detail.

Design Options for Customized Checks

When it comes to designing your personalized checks, the possibilities are endless. Here are some popular design options to consider:

- Photographic Images: Add a personal photo or artwork to your checks for a truly unique design.

- Color Schemes: Choose from a variety of color options to match your personal style or brand.

- Font Styles: Select from various font options to personalize your checks further.

Many providers offer templates to help you create the perfect design. You can also upload your custom artwork or logo for a more personalized touch.

Security Features in Personal Checks

Security is a critical consideration when ordering customized personal checks. Here are some of the most common security features:

- Watermarks: Invisible to the naked eye, watermarks are embedded in the paper to prevent counterfeiting.

- Color-Shifting Ink: This ink changes color when viewed from different angles, making it difficult to replicate.

- Microprinting: Tiny text that is difficult to reproduce, adding an extra layer of security.

These features ensure that your checks are secure and less likely to be forged. Always choose a reputable provider that offers these security enhancements.

Costs and Pricing for Customized Checks

The cost of customized personal checks varies depending on several factors, including the design complexity, quantity, and provider. On average, you can expect to pay between $10 and $30 for a pack of 100 checks. Some providers offer discounts for bulk orders or when ordering additional accessories, such as checkbooks or deposit slips.

Here are some factors that can affect pricing:

- Design Complexity: More intricate designs may increase the cost.

- Quantity: Larger orders often come with discounted rates.

- Security Features: Additional security features may add to the overall cost.

How to Order Customized Personal Checks

Ordering customized personal checks is a straightforward process. Follow these steps to ensure a seamless experience:

- Choose a reputable provider that offers personalized checks.

- Select your design options, including colors, fonts, and images.

- Provide your personal information, such as name and address.

- Review your order for accuracy and place your order.

Many providers offer online ordering systems, making it easy to customize and order your checks from the comfort of your home.

Popular Providers of Customized Checks

When selecting a provider for your customized personal checks, consider the following popular options:

- Checks Unlimited: Offers a wide range of design options and competitive pricing.

- Personal Checks Plus: Known for its high-quality checks and excellent customer service.

- Check Advantage: Provides secure and customizable checks with advanced security features.

Each provider has its own strengths, so be sure to research and compare before making a decision.

Tips for Choosing the Right Design

Selecting the perfect design for your customized personal checks can be challenging. Here are some tips to help you make the right choice:

- Consider Your Audience: Choose a design that reflects your personal style or brand.

- Keep It Simple: Avoid overly complex designs that may be difficult to read or reproduce.

- Focus on Security: Prioritize security features when selecting your design.

By following these tips, you can ensure your checks are both stylish and secure.

Legal and Security Considerations

When ordering customized personal checks, it's essential to consider legal and security aspects. Here are some key points to keep in mind:

- Verify Provider Credentials: Ensure the provider is reputable and follows industry standards.

- Protect Your Information: Be cautious when sharing personal information online and use secure platforms for ordering.

- Monitor Your Account: Regularly review your bank statements to detect any unauthorized transactions.

By taking these precautions, you can minimize the risk of fraud and ensure your financial security.

The Future of Personal Checks

While the use of checks has declined with the rise of digital payment methods, they remain a vital component of the financial landscape. Customized personal checks continue to offer a level of security and personalization that digital alternatives often lack. As technology advances, we may see innovations in check design and security features, ensuring their relevance in the years to come.

According to a report by the Federal Reserve, checks are still used for approximately 7% of all noncash payments in the United States. This statistic highlights the continued importance of personalized checks in certain transactions.

Conclusion

In conclusion, customized personal checks offer a practical and stylish way to manage your finances. With numerous design options, advanced security features, and competitive pricing, personalized checks remain a valuable tool for individuals and businesses alike. By following the tips and considerations outlined in this guide, you can make informed decisions when choosing or designing your checks.

We invite you to share your thoughts and experiences in the comments below. Have you used customized personal checks? What design features do you find most appealing? Don't forget to explore other articles on our website for more insights into financial management and personalization.