When it comes to property valuation, the role of a Davenport County Property Appraiser cannot be overstated. Whether you're buying, selling, or investing in real estate, understanding how property values are determined is crucial for making informed decisions. This comprehensive guide delves into everything you need to know about property appraisers in Davenport County, including their responsibilities, the appraisal process, and how it impacts your financial future.

Property valuation isn't just about numbers; it's about ensuring fairness and transparency in the real estate market. The Davenport County Property Appraiser plays a vital role in this process by providing accurate and impartial assessments of property values. Whether you're a homeowner, a buyer, or a seller, understanding the appraiser's role will empower you to navigate the real estate landscape with confidence.

In this article, we'll explore the ins and outs of Davenport County's property appraisal system, offering you actionable insights and expert advice. From the basics of property appraisal to advanced tips on challenging an assessment, this guide is designed to equip you with the knowledge you need to succeed in the real estate market. Let's get started!

Read also:Pron Understanding Its Linguistic Role And Importance

Table of Contents

- Introduction to Davenport County Property Appraiser

- Role of the Property Appraiser

- The Property Appraisal Process

- How Property Appraisals Impact Taxes

- Challenging a Property Appraisal

- Resources for Homeowners

- Understanding the Real Estate Market

- Tips for Maximizing Property Value

- Common Misconceptions About Property Appraisers

- The Future of Property Appraisals

Introduction to Davenport County Property Appraiser

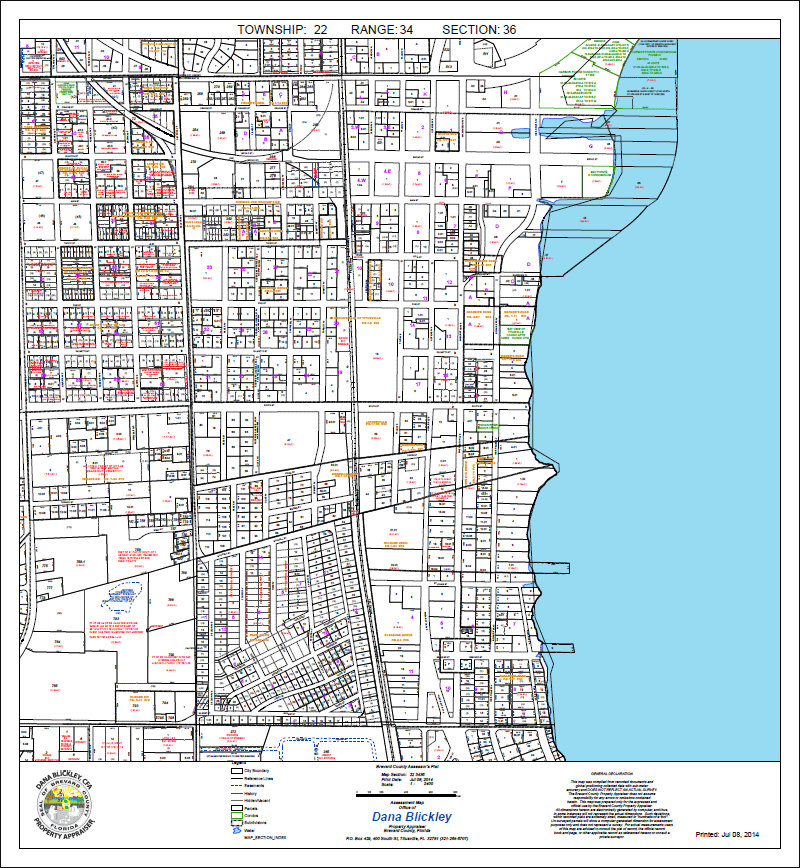

Understanding the Davenport County Property Appraiser is the first step in navigating the complexities of property valuation. The appraiser's office is responsible for assessing all real estate properties within the county, ensuring that values are fair and consistent. This assessment is critical for determining property taxes and guiding real estate transactions.

Why Property Appraisals Matter

Property appraisals matter because they directly affect your financial obligations as a homeowner. Whether you're buying a new home or selling your current one, the assessed value can influence everything from mortgage rates to tax liabilities. Additionally, property appraisals help maintain the integrity of the real estate market by providing a benchmark for fair pricing.

Here are some key reasons why property appraisals are important:

- They determine property tax assessments.

- They provide a basis for mortgage financing.

- They ensure fair market pricing for buyers and sellers.

Role of the Property Appraiser

The Davenport County Property Appraiser plays a multifaceted role in the real estate ecosystem. Their primary responsibility is to assess the value of all properties within the county. However, their duties extend beyond valuation. Appraisers also maintain property records, conduct field inspections, and ensure compliance with state and federal regulations.

Key Responsibilities

Here are the key responsibilities of a property appraiser:

- Conducting property inspections.

- Updating property records regularly.

- Providing transparent communication with property owners.

The Property Appraisal Process

The property appraisal process involves several steps, each designed to ensure accuracy and fairness. From initial inspections to final assessments, the process is methodical and thorough. Understanding these steps can help you prepare for your property appraisal and address any concerns that may arise.

Read also:Monalita Ed The Remarkable Journey Of A Rising Star In The Entertainment Industry

Step-by-Step Guide to the Appraisal Process

Here's a breakdown of the appraisal process:

- Inspection: An appraiser visits the property to assess its condition and features.

- Data Collection: The appraiser gathers information about comparable properties in the area.

- Valuation: Using data and analysis, the appraiser determines the property's market value.

- Notification: Property owners receive a notice of their assessed value.

How Property Appraisals Impact Taxes

Property appraisals have a direct impact on property taxes. The assessed value of your property determines the amount of taxes you owe each year. This is why it's important to ensure that your property is accurately assessed. Overvalued properties can lead to higher tax burdens, while undervalued properties may result in lost revenue for local governments.

Understanding Property Tax Calculations

Property taxes are calculated based on the assessed value of your property and the local tax rate. Here's how the calculation works:

- Assessed Value × Tax Rate = Property Tax Amount

For example, if your property is assessed at $200,000 and the local tax rate is 2%, your annual property tax would be $4,000.

Challenging a Property Appraisal

If you believe your property has been overvalued, you have the right to challenge the appraisal. The process involves submitting a formal appeal to the Davenport County Property Appraiser's office. It's important to gather evidence to support your claim, such as recent sales of comparable properties or a professional appraisal report.

Steps to Appeal an Appraisal

Here are the steps to appeal a property appraisal:

- Gather evidence to support your claim.

- Submit a formal appeal to the appraiser's office.

- Attend a hearing if necessary.

- Receive a final decision from the appraiser.

Resources for Homeowners

Davenport County offers several resources to help homeowners understand the appraisal process and their rights. These resources include online tools, guides, and contact information for the appraiser's office. Taking advantage of these resources can help you make informed decisions about your property.

Useful Tools and Guides

Here are some useful tools and guides for homeowners:

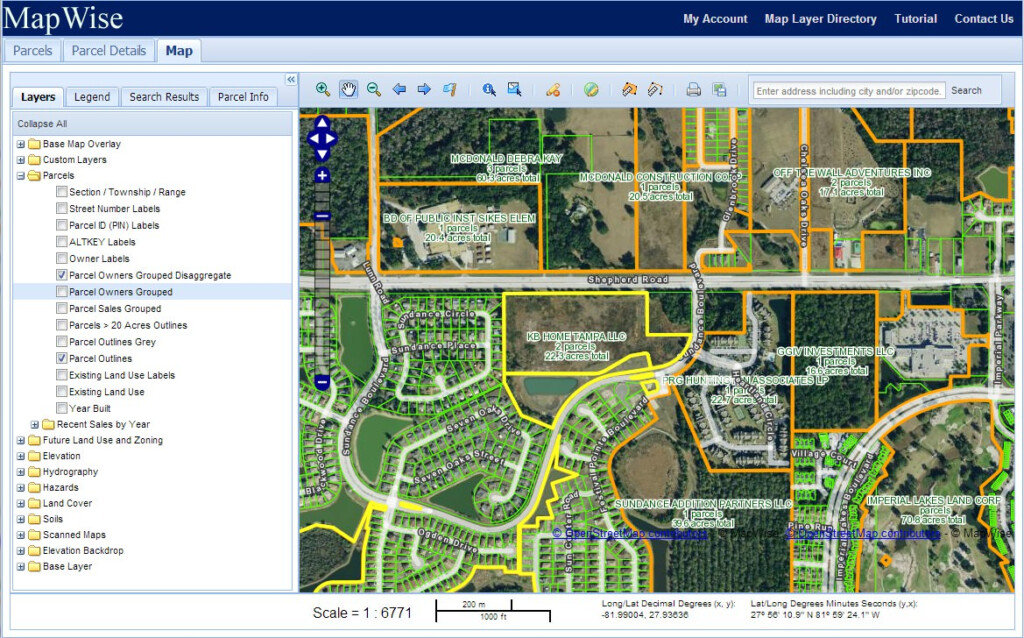

- Property Search Tool: Access property records and assessments online.

- Appeal Guide: Learn how to appeal a property appraisal.

- Contact Information: Find the appraiser's office phone number and email.

Understanding the Real Estate Market

The real estate market in Davenport County is influenced by a variety of factors, including economic trends, population growth, and local development projects. Understanding these factors can help you anticipate changes in property values and make strategic decisions about buying or selling.

Key Factors Affecting Property Values

Here are some key factors that affect property values:

- Economic Conditions: Employment rates and income levels impact buying power.

- Supply and Demand: The balance between available properties and buyers drives prices.

- Location: Proximity to schools, parks, and amenities influences property appeal.

Tips for Maximizing Property Value

Maximizing your property's value requires a combination of maintenance, upgrades, and strategic planning. Whether you're preparing for a sale or looking to increase your property's appeal, these tips can help you achieve your goals.

Strategies for Increasing Property Value

Here are some strategies for increasing property value:

- Perform regular maintenance on your home.

- Upgrade key features like kitchens and bathrooms.

- Enhance curb appeal with landscaping and exterior improvements.

Common Misconceptions About Property Appraisers

There are several misconceptions about property appraisers that can lead to confusion and frustration. For example, many people believe that appraisers set property taxes, when in fact, they only assess property values. Understanding these misconceptions can help you better navigate the appraisal process.

Clearing Up Misconceptions

Here are some common misconceptions about property appraisers:

- Appraisers set property taxes (they only assess values).

- Appraisals are subjective (they are based on data and analysis).

- Property owners cannot challenge appraisals (they have the right to appeal).

The Future of Property Appraisals

As technology advances, the future of property appraisals is likely to become more efficient and accurate. Tools like artificial intelligence and drones are already being used to enhance the appraisal process. These innovations promise to streamline inspections and improve data collection, benefiting both appraisers and property owners.

Emerging Trends in Property Appraisal

Here are some emerging trends in property appraisal:

- Use of AI for data analysis.

- Drone inspections for hard-to-reach areas.

- Increased transparency through online portals.

Kesimpulan

In conclusion, the Davenport County Property Appraiser plays a vital role in maintaining the integrity of the real estate market. By understanding the appraisal process, your rights as a homeowner, and the factors that influence property values, you can make informed decisions about your property. Whether you're buying, selling, or investing, this knowledge will empower you to navigate the real estate landscape with confidence.

We encourage you to take action by exploring the resources available through the Davenport County Property Appraiser's office. If you have questions or concerns, don't hesitate to reach out for clarification. Additionally, feel free to share this article with others who may benefit from its insights. Together, we can ensure a fair and transparent real estate market for everyone.

For more information on real estate topics, check out our other articles and resources. Your journey to property ownership starts here!

References: