The Colonial Penn scandal has captured public attention, raising critical questions about corporate ethics and accountability in the insurance industry. This controversy revolves around Colonial Penn, a prominent player in the life insurance market, and its alleged fraudulent practices. As we delve into this issue, we aim to provide an in-depth understanding of the scandal, its implications, and the broader lessons it offers for consumers and regulators.

Insurance scandals often highlight vulnerabilities in the financial system, and the Colonial Penn scandal is no exception. This case underscores the importance of transparency, integrity, and oversight in the insurance sector. By examining the details of the scandal, we can better understand how such issues arise and how they can be addressed.

This article will explore the Colonial Penn scandal comprehensively, covering its origins, key events, legal proceedings, and the impact on stakeholders. We will also discuss the broader implications for the insurance industry and what consumers can do to protect themselves from similar issues in the future.

Read also:Anna Malygon S The Inspiring Journey Of A Rising Star

Table of Contents

- Overview of Colonial Penn Scandal

- History of Colonial Penn Insurance

- Key Allegations in the Scandal

- Legal Proceedings and Outcomes

- Regulatory Response to the Scandal

- Impact on Consumers and Stakeholders

- Lessons Learned from the Scandal

- Preventing Future Scandals

- Broader Implications for the Insurance Industry

- Conclusion and Call to Action

Overview of Colonial Penn Scandal

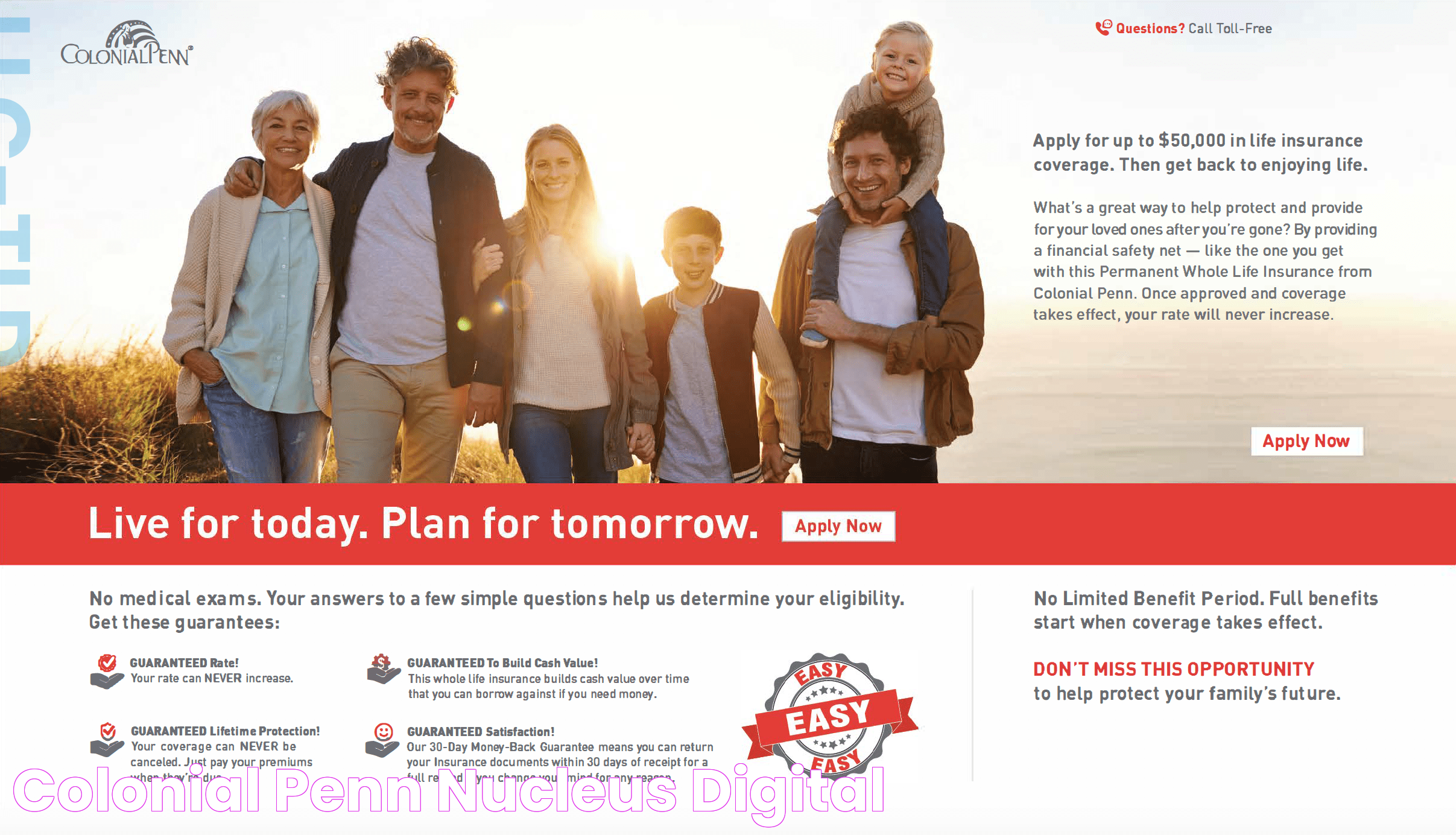

The Colonial Penn scandal emerged as a significant controversy in the insurance industry, shedding light on unethical practices that allegedly occurred within the company. Colonial Penn, known for its affordable life insurance policies, was accused of misleading customers and engaging in deceptive marketing tactics. These allegations sparked widespread concern among consumers and regulators alike.

At the heart of the scandal lies the accusation that Colonial Penn misrepresented policy benefits, failed to disclose important terms, and engaged in aggressive sales techniques. Such practices not only violated consumer trust but also raised questions about the company's commitment to ethical standards.

Understanding the Scope of the Scandal

The scope of the Colonial Penn scandal extends beyond individual consumer complaints, affecting thousands of policyholders nationwide. According to a report by the National Association of Insurance Commissioners (NAIC), numerous complaints were filed against the company, citing issues such as:

- Misrepresentation of policy terms

- Failure to honor claims

- Unfair cancellation practices

These allegations prompted a thorough investigation by regulatory authorities, leading to significant legal and financial consequences for the company.

History of Colonial Penn Insurance

Colonial Penn Insurance, established in the early 20th century, has long been recognized for its focus on providing affordable life insurance solutions. Over the years, the company gained a reputation for offering policies tailored to meet the needs of middle-class families. However, the scandal has tarnished its image, raising questions about its business practices and ethical standards.

Key Milestones in Colonial Penn's History

Colonial Penn's journey through the insurance landscape includes several notable milestones:

Read also:Anjali Videos A Comprehensive Guide To The Rising Star

- Founding in the early 1900s with a mission to provide accessible life insurance

- Expansion into new markets and product offerings

- Acquisition by larger insurance conglomerates in the late 20th century

Despite its storied history, the company's recent actions have brought it under scrutiny, forcing it to address longstanding issues related to transparency and accountability.

Key Allegations in the Scandal

The Colonial Penn scandal is centered around several key allegations that highlight the company's alleged misconduct. These allegations include:

- Misrepresentation of Policy Benefits: Customers accused the company of exaggerating policy benefits during the sales process.

- Failure to Disclose Important Terms: Policyholders claimed that critical details about premiums and coverage were not adequately disclosed.

- Aggressive Sales Tactics: The company was accused of employing high-pressure sales techniques to push policies on unsuspecting consumers.

These allegations were supported by documented evidence and testimonies from affected customers, prompting regulatory authorities to take action.

Consumer Complaints and Testimonies

Consumer complaints played a crucial role in uncovering the extent of the scandal. Many policyholders reported feeling misled and frustrated by the company's handling of their claims. For instance:

- One customer recounted how the company failed to honor a claim despite providing proof of death.

- Another policyholder described being pressured into purchasing additional coverage without understanding the implications.

These testimonies contributed to the growing body of evidence against Colonial Penn, reinforcing the need for accountability and reform.

Legal Proceedings and Outcomes

The Colonial Penn scandal led to extensive legal proceedings, with regulatory authorities and consumer protection agencies taking decisive action against the company. Lawsuits were filed on behalf of affected policyholders, seeking compensation for damages incurred due to the company's alleged misconduct.

In 2022, a landmark settlement was reached, requiring Colonial Penn to pay millions in restitution to affected customers. The settlement also mandated the implementation of stricter compliance measures to prevent future violations.

Key Legal Outcomes

The legal proceedings against Colonial Penn resulted in several significant outcomes:

- Payment of restitution to affected policyholders

- Adoption of enhanced transparency and disclosure practices

- Implementation of stricter oversight mechanisms

These outcomes reflect the seriousness with which regulatory authorities addressed the scandal, ensuring that consumers receive fair treatment and compensation.

Regulatory Response to the Scandal

Regulatory bodies played a pivotal role in addressing the Colonial Penn scandal, implementing measures to protect consumers and restore trust in the insurance industry. The National Association of Insurance Commissioners (NAIC) and state insurance departments collaborated to investigate the allegations and impose appropriate sanctions.

As part of their response, regulators mandated that Colonial Penn undergo rigorous audits and adopt comprehensive compliance programs. These measures were designed to ensure that the company adheres to ethical standards and operates in the best interests of its policyholders.

Regulatory Reforms and Initiatives

The scandal prompted several regulatory reforms and initiatives aimed at strengthening oversight in the insurance sector:

- Enhanced disclosure requirements for insurance policies

- Increased penalties for companies engaging in deceptive practices

- Expanded consumer education programs to empower policyholders

These reforms underscore the importance of proactive regulation in safeguarding consumer rights and promoting fair business practices.

Impact on Consumers and Stakeholders

The Colonial Penn scandal had far-reaching implications for consumers, stakeholders, and the insurance industry as a whole. Policyholders faced financial hardships due to the company's alleged misconduct, while investors and employees grappled with the consequences of the scandal.

For consumers, the scandal highlighted the need for vigilance when purchasing insurance products. It underscored the importance of carefully reviewing policy terms, asking questions, and seeking advice from trusted professionals before making a decision.

Lessons for Consumers

Consumers can learn valuable lessons from the Colonial Penn scandal to protect themselves from similar issues in the future:

- Thoroughly review policy documents and ask clarifying questions

- Seek multiple quotes and compare offerings from different providers

- Engage with reputable insurance agents and brokers

By adopting these practices, consumers can make informed decisions and avoid falling victim to unethical business practices.

Lessons Learned from the Scandal

The Colonial Penn scandal offers important lessons for both the insurance industry and consumers. It highlights the critical importance of transparency, accountability, and ethical conduct in maintaining trust and integrity in the marketplace.

For companies, the scandal serves as a reminder of the need to prioritize customer satisfaction and adhere to regulatory standards. By fostering a culture of transparency and accountability, businesses can build long-term relationships with their customers and avoid costly legal and reputational consequences.

Best Practices for Insurance Companies

To prevent future scandals, insurance companies should adopt the following best practices:

- Implement robust compliance programs and regular audits

- Provide clear and concise policy information to consumers

- Train employees and agents on ethical sales practices

By adhering to these principles, companies can enhance their reputation and contribute to a more trustworthy insurance marketplace.

Preventing Future Scandals

Preventing future insurance scandals requires a multi-faceted approach involving regulatory oversight, industry self-regulation, and consumer education. Regulatory authorities must continue to enforce strict standards and impose meaningful penalties for violations. At the same time, industry players should commit to upholding ethical standards and fostering transparency in their operations.

Consumer education plays a vital role in preventing scandals, empowering individuals to make informed decisions and hold companies accountable for their actions. By promoting financial literacy and awareness, we can create a more informed and vigilant consumer base.

Role of Technology in Prevention

Technology can play a significant role in preventing insurance scandals by enhancing transparency and accountability. Digital tools such as blockchain and artificial intelligence can be used to track transactions, monitor compliance, and detect fraudulent activities in real-time. These innovations offer promising solutions for addressing the challenges faced by the insurance industry.

Broader Implications for the Insurance Industry

The Colonial Penn scandal has broader implications for the insurance industry, highlighting systemic issues that require attention and reform. It underscores the need for greater transparency, stronger regulatory frameworks, and more robust consumer protection measures. By addressing these challenges, the industry can restore trust and credibility in the eyes of the public.

In addition, the scandal highlights the importance of innovation and adaptability in the insurance sector. Companies that embrace digital transformation and adopt customer-centric approaches are better positioned to succeed in an increasingly competitive marketplace.

Emerging Trends in the Insurance Industry

Several emerging trends in the insurance industry offer opportunities for growth and innovation:

- Increased adoption of digital platforms and tools

- Growing emphasis on personalized and customized solutions

- Expansion of coverage options to meet evolving consumer needs

By staying ahead of these trends, insurance companies can enhance their offerings and better serve their customers.

Conclusion and Call to Action

The Colonial Penn scandal serves as a stark reminder of the importance of transparency, accountability, and ethical conduct in the insurance industry. By examining the details of the scandal and its implications, we gain valuable insights into how such issues arise and how they can be addressed. Consumers, regulators, and industry players all have a role to play in preventing future scandals and promoting a more trustworthy insurance marketplace.

We encourage readers to take action by educating themselves about insurance products, staying informed about industry developments, and holding companies accountable for their actions. Together, we can create a more transparent and trustworthy insurance landscape that benefits everyone involved.

Feel free to share your thoughts and experiences in the comments section below. For more informative articles and insights, explore our website and subscribe to our newsletter.